Virtual IBANs vs. IBANs

Global cross-border payments were worth $156 trillion in 2022 - almost $18 billion for every hour of every day. Moving across the world via a tangled network of bank systems, rules, and laws, huge sums of money require secure guidance to help them reach their destination.

IBANs are identifiers that support the transfer of money across borders. Along with their virtual cousins, vIBANS (virtual IBANS), they carry unique identification to separate and target the recipient’s bank account from the billions of accounts worldwide. However, as vital as these identifying markers are, many people are unsure about what they really do, how to find them, and what the difference is between the two.

Read on to find out more about vIBANs and IBANS and how they are essential to the flow of international payments.

What is an IBAN?

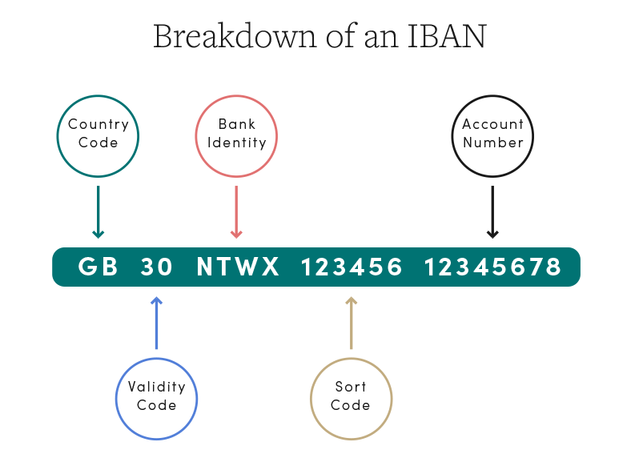

An IBAN is an identifier used to make or receive international bank payments. IBAN stands for International Bank Account Number, (although people often use the term IBAN number, this is an incorrect description as it is the same as saying ‘International Bank Account Number Number’). IBANs incorporate the recipient’s bank account number plus other numerical information to help payments from overseas banks find a clear pathway through the global banking network.

Separate from your bank account number and bank sort code, and comprising up to 34 letters and numbers, IBANs include information about the account holder’s specific bank, the country their bank is in, and a combination of other account details. This enhanced level of coded security reduces risk, transaction errors, rejected payments, and transfer delays across borders. IBANs are unique to your bank account. No two are the same. IBANs can only be used to send or receive funds bank to bank. They can’t be used for other transactions, such as cash withdrawals.

What is a vIBAN?

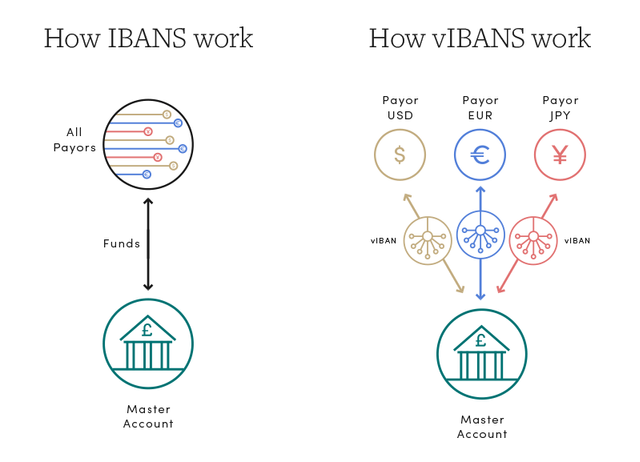

A virtual IBAN (virtual International Bank Account Number, or vIBAN) looks exactly the same as a regular IBAN and performs the same routing function for international payments. However, where a regular IBAN is matched to only one bank account in the world, and it funnels all overseas payments into that account, a virtual IBAN holder may have multiple unique vIBANs in multiple currencies that send their payments to a single pooled account. Think of a vIBAN as a linked sub-account of a central master account, allowing payments to be separated, routed and received internationally.

VIBANS allow the master account holder to immediately identify where and from whom payments have come from, or to easily send payments to individual payees. Instead of overseas payors sending their funds into one master account, where the account holder must identify who sent what, when each payor is given a unique vIBAN, there is no need to enter any additional identifying information. It is instantly clear to the master account holder where each incoming payment originated.

Does a VIBAN Also Need an IBAN?

Yes, it does. No matter if you have one or hundreds of vIBANs, just as the spokes on a wheel are always connected to a central hub, vIBANs are always linked to a master bank account. vIBANS feed all their incoming payments into the master account and may also be used to disperse outgoing funds to overseas suppliers. A vIBAN cannot function without being mapped to a master bank account identified by its IBAN.

Where Can I Find My IBAN?

Your IBAN doesn’t replace your bank sort code and bank account number ─ it’s an additional number with extra information to help overseas banks identify your account for payments. You can find your IBAN on your bank statement or via your online banking account.

Where Can I Find My VIBAN?

You cannot find your vIBAN on your regular bank statement. VIBANS are generated to order by specialist providers and are mapped to the master account.

What Are vIBANs and IBANS for?

VIBANs and IBANs support the transfer of funds across borders. The international banking system is multi-network, with different processes and protocols forming a worldwide mesh. However, differing rules, laws, and operating methods can slow or sometimes harm the transfer of money from one country to another. VIBANs and IBANs are designed to cut a pathway through this thicket of regulations and ensure swift and accurate transfers of funds.

Who Would Use VIBANs?

Any organisation or individual who sends or receives funds from overseas. Ideal for businesses engaged in cross-border trade, vIBAN accounts can be set up in a variety of currencies and can be allocated to clients, suppliers, even individual projects.

What Are the Benefits of VIBANs?

VIBANs can allow businesses to collect and pay in a variety of currencies and across multiple jurisdictions without having to establish more than one banking relationship. They also help the recipients of international funds to readily identify their payors, and to make payments to overseas suppliers more easily. Additionally, vIBANs can automatically convert foreign currencies to their local currency before they are transferred to the master bank account. This can save on FX costs and banking charges as well as eliminate the need to juggle multiple bank accounts. In short, vIBANs can bring a smoother reconciliation process to the account holder’s international payments.

VIBANS: A Fintech Solution for Today and Tomorrow

VIBANs give clearer insight into an organisation’s or individual’s international payments, as well as reducing the time it takes for funds to process. As globalisation, just-in-time delivery, and rapidly advancing technologies accelerate the worldwide flow of goods and services, so there is a need for greater accuracy and increased speed in cross-border payments. VIBANs are the best solution to meet this growing challenge.

Reduce the Uncertainty of Cross-Border Payments with VIBANs

Businesses that engage in cross-border trade must reduce the financial impact of potential uncertainties by mitigating their exposure to currency risk. Exchanging money into another currency and transferring it overseas can be daunting and confusing. Aware of this, when you join us you will be assigned a dedicated account manager to help you cut through the jargon.

Our API service provides businesses that conduct high volumes of foreign exchange transactions with the convenience they need to manage their requirements effectively. By acting as your embedded API partner, we can enable your business to exchange currencies and execute international payments in a matter of seconds at scale.

Mitigate the impact of currency risk on your international payments with forward contracts, stop losses and more - open an account with Clear Treasury today for quick, secure, and cost-effective international currency transfers.

Related Articles

Virtual IBANs: Why Your Business Needs Them

All bank accounts have an International Bank Account Number (IBAN). First introduced in the 1990s, IBANs underpin the process of sending and receiving money across borders. This standardised international numbering system allows financial providers anywhere in the world to identify your bank account.

Read more

How Fintech is Transforming Cross-Border Payments

Globalisation and technology have revolutionised international trade. Billions of tons of products now move seamlessly from one side of the earth to another. Just-in-time delivery has become critical to non-stop production.

Read more

Top Fintech International Payment Trends to Expect in 2023

Customer-centricity has always been a top priority for providers of international payment services, right? Wrong. For too long, this pragmatic approach to doing business that focuses on delivering a positive customer experience to drive profit and gain competitive advantage was an afterthought.

Read more