A Guide to Types of Payment Methods in International Trade

During the last seven decades, international trade has grown exponentially. The global volume of exports jumped from $61 billion in 1950 to over $17 trillion in 2018. The first reason behind this rise was the rule-based order which harmonised relationships between countries. The second was a maturing global financial system that offered different modes of payment in international trade and facilitated the transfer of $17 trillion in 2018.

This financial system, which powers international trade like an electricity grid, offers several means of payment that global businesses can use. This article will explore those methods, their advantages and disadvantages, and when you should choose each.

Methods of payment in international business

Cash in advance

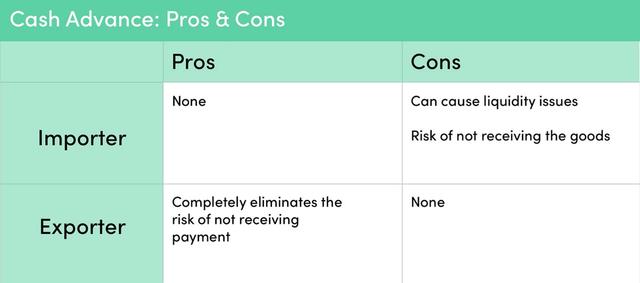

With “cash in advance” or “cash on order”, the importer pays the amount due upfront to the exporter before shipment and delivery of goods. This method eliminates payment risk entirely for the exporter but can be demanding in terms of liquidity for the importer.

Often, the importer does not pay the entire amount all at once because there is a risk of not receiving the goods. Instead, they pay a percentage (say, 30%) of the amount when they place the order and then pay the remainder (70%) upon production initiation or completion. The payment can be made via a wire transfer, credit or debit card, or any other means of payment.

Given that this option is skewed in favour of the seller, the foreign buyer usually only accepts it when they are highly dependent on the seller, such as when the seller has a monopoly over a product or when buyers cannot obtain a letter of credit or use other methods of payment.

Cash advance pros & cons

Tip:

As a buyer, you should accept this payment method only when there is no other option. As a seller, you should accept it whenever the option is on the table.

Letter of credit (L/C)

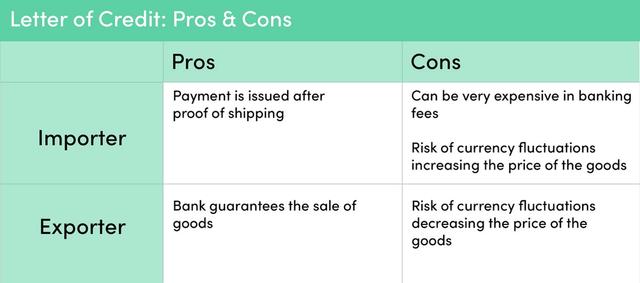

A letter of credit is a suitable option when the relationship between the trade partners is new, and the exporter is uncertain about the importer’s creditworthiness. This is where the importer’s bank steps in and issues a letter of credit (L/C) to the exporter’s bank for assurance.

The L/C acts as proof to the seller that the issuing bank will reimburse them for the goods being exported. The importer’s bank does not release funds to the exporter’s bank unless the exporter submits the documents required to prove shipping. Those documents typically include the inspection documents which prove that the goods meet the agreed-upon specifications and the shipping documents such as the bill of lading and the commercial invoice.

Upon receiving those documents, the exporter’s bank verifies them and confirms the same to the importer’s bank, making the payment to the exporter’s bank as agreed. The process is fulfilled when the payment is released to the exporter, and the documents are released to the importer.

This payment method is considered the safest mode of payment in international trade, but it is also costly given the bank fees associated with it. There is also the risk of exchange rate fluctuations which could negatively impact the amount of money paid to the exporter. Importers and exporters must weigh the costs and benefits and choose accordingly.

Letter of credit pros & cons

Tip:

- As a buyer or a seller, you should accept this method when there is little trust in your trade partner and when the trade volume justifies the costs.

- You should also consider fixing the exchange rate to eliminate the risk of exchange rate fluctuations. Find out more by speaking to a currency expert at Clear Treasury.

Documentary collections (D/C)

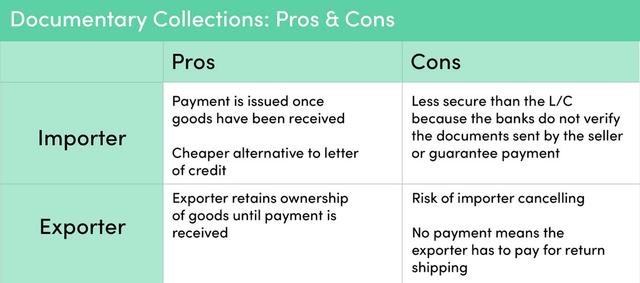

This is a more balanced and less costly payment method in international trade. Similar to a letter of credit, banks acting on behalf of the exporter and importer are also involved to protect the interests of both parties.

After agreeing on a sales deal, the exporter sends a bill of exchange (also called a draft) to their bank to be sent on to the importer’s bank. Once the exporter ships the goods, they then send the shipping documents (bill of lading, commercial invoice, and others) to their bank. The exporter’s bank then sends those documents to the importer’s bank.

The importer’s bank receives the documents and releases them either upon receiving payment (a.k.a. payment at sight or documents against payment) or at a later agreed-upon date (documents against acceptance).

Even though this method is less expensive, it is considered less secure than the L/C. This is because the banks do not verify the documents sent by the seller or guarantee payment.

Documentary collections pros & cons

Tip:

As a seller or a buyer, you should choose this method when you trust your trade partner well and when you want to save some costs associated with document verification.

Open account (O/A)

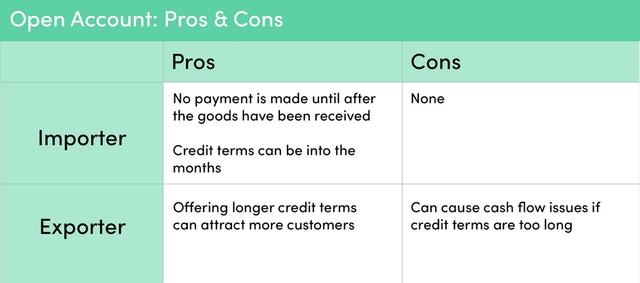

Under an open account agreement, the seller agrees to ship the products in advance to the importer and receive payment at a later date. Frequently, payment takes place one, two, or even three months after delivery. That is, shipping takes place upfront, which is the opposite of cash in advance.

In effect, an open account means that the exporter has lent the amount due to the importer for a specified period and may suffer a loss in case the importer does not pay for whatever reason. Thus, it requires a sufficient level of faith in the importer on the part of the exporter.

This payment method is the most convenient and favourable for importers. However, it is costly in terms of liquidity and very risky for exporters.

Open account pros & cons

Tip:

As a seller, you should choose this method when you significantly trust the importer and have excess liquidity. As a buyer, you should choose this method when you trust the quality of the products to be delivered and need liquidity.

Consignment

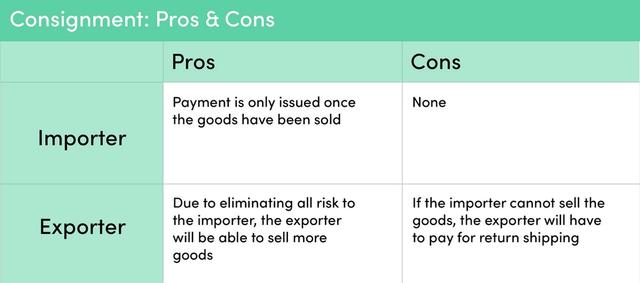

Under this type of agreement, the exporter ships the goods to the importer and agrees to receive payment for the goods only when they’re sold. The possession of the goods belongs to the exporter the entire time and, if they are not sold, the exporter probably has to cover the costs of return shipping, among other expenses. Moreover, the exporter bears the costs of any risk, such as a robbery or fire.

The exporters and importers usually choose this type of agreement when they have a distributor relationship. The exporter chooses a reputable distributor abroad and ships the products to sell them in a foreign market. Despite this, this type of agreement requires exceptional trust in the importer, and it is rare considering how risky it is for the exporters.

Consignment pros & cons

Tip:

As a buyer, this is an ideal agreement for you, but as a seller, you should avoid such terms given their significantly higher risks unless you have extremely high confidence in the saleability of your products.

How to pick the best payment method

Each of these payment methods for international trade has its advantages and disadvantages. Exporters and importers must consider the trade-offs for each one and choose the method that suits them best depending on various factors. These factors can include the relationship and level of trust between the exporters and importers, their reputability and bargaining power, the political and economic condition in the origin and destination countries, market conditions, and the specific norms of the industry in question.

With that being said, your choice of financial intermediary should matter just as much as the payment method. Choosing a partner you can trust means they will propose the best solutions based on the situation at hand, and protect your interests, when your relationship with the trade partners abroad is rocky.

If you believe in choosing the right partner first and payment method second, you should consider using Clear Treasury for your international payments. Our payment solutions work with all of the payment methods above, and we have a dedicated team of trade finance and currency experts who can advise you on the best course of action in every scenario. Get in touch with Clear Treasury today.

Related Articles

Daily Analysis: GBP/USD Hits 14-Month Lows Amid Severe Economic Uncertainty

Our daily analysis of EUR, GBP and USD.

Read more

Weekly Round-Up & The Week Ahead

Our weekly round-up and a look at the week ahead for EUR, GBP and USD.

Read more

The Rise of B2B Cross-Border Payments

Businesses that wish to protect their overseas markets or expand their international trade, must innovate their payments processes internally, or in concert with a technologically advanced fintech provider. Read on to discover more about the rise of cross-border B2B payments and what your business needs to do to stay ahead.

Read more